Americans Want More Sleep (and They’re Motivated to Find a Way)

Brado, an insight-driven marketing agency, used Realtime Polling to expand their market research efforts around Americans’ sleeping habits. Read below for insights and results.

We’re probably not the first to tell you: Most American adults aren’t sleeping well. We not only lack the sleep we need, but we also recognize there’s plenty of room for improvement and understand how extra sleep could benefit us.

Highlights

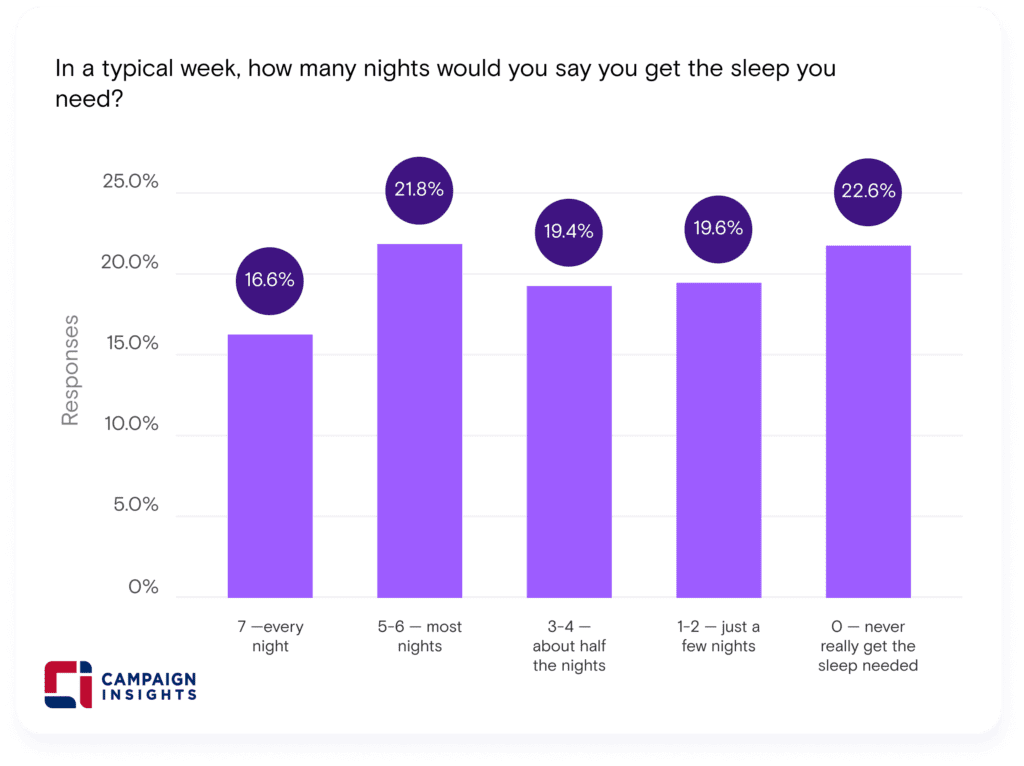

- Restless nights. More than one in five (23%) respondents say they never get the sleep they need. For another 20%, that needed rest is relatively rare, occurring just a few nights in a typical week. Only 17% of respondents say they get their needed every night.

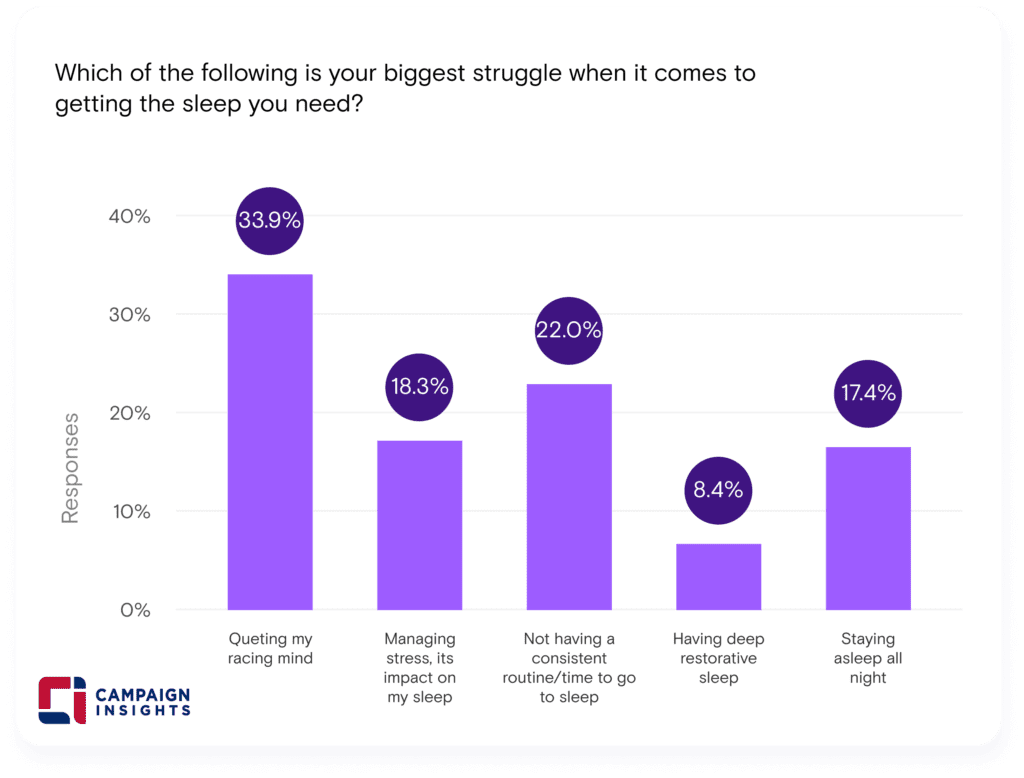

- Tough transitions. Many respondents have trouble navigating the transition from wakefulness to slumber. Racing minds plague a little more than one-third (34%) of respondents, and nearly one in five (18%) pin the blame on the accumulated stresses of the day. And, validating the results of our previous survey, many respondents attribute lack of sleep to inconsistent sleep habits, such as the absence of a reliable bedtime (22%).

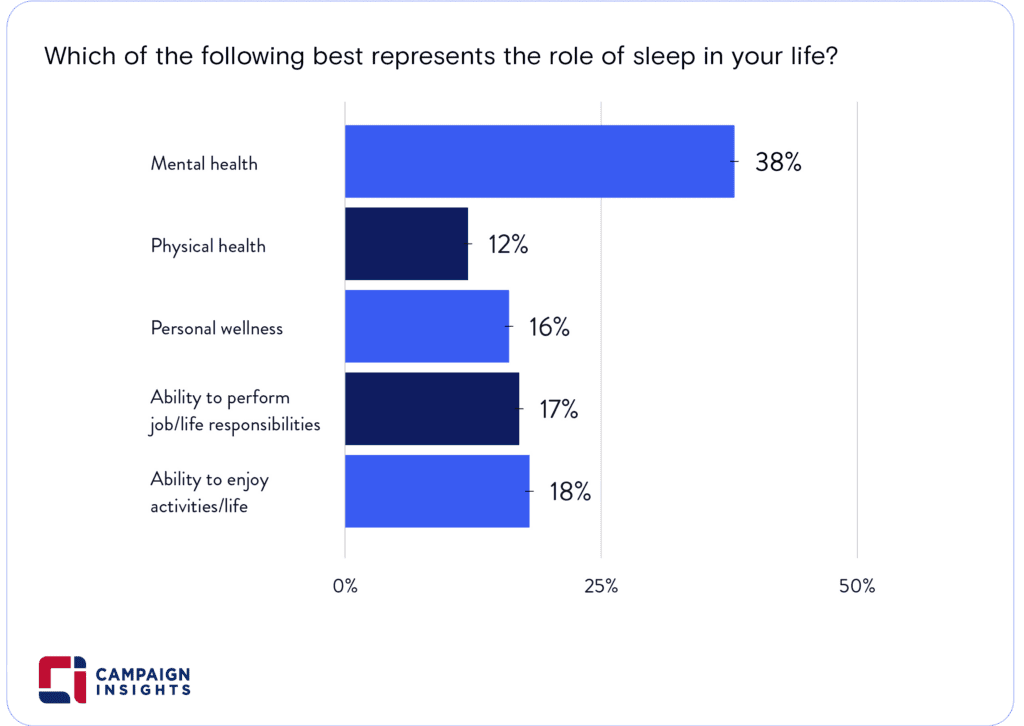

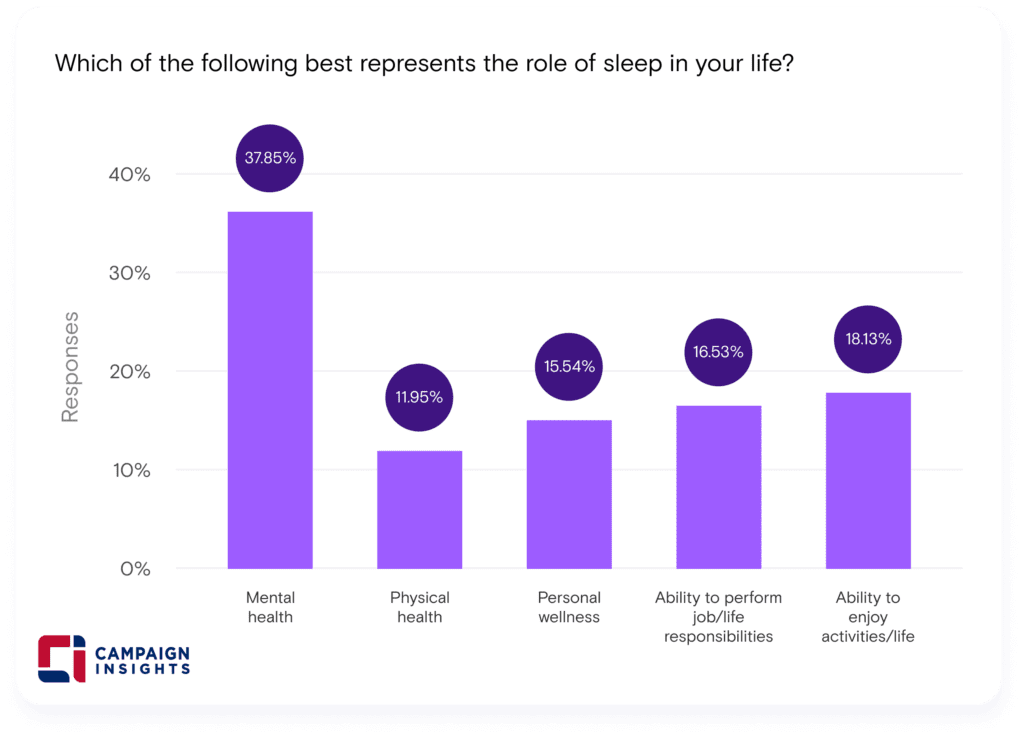

- The role of sleep. The benefits of sleep abound. Mental health tops that list, with 38% of the people surveyed selecting it as the most important outcome. Respondents also ascribe physical health and personal wellbeing as important outcomes (12 and 18% respectively). Others connect personal productivity and focus to the restorative power of sleep.

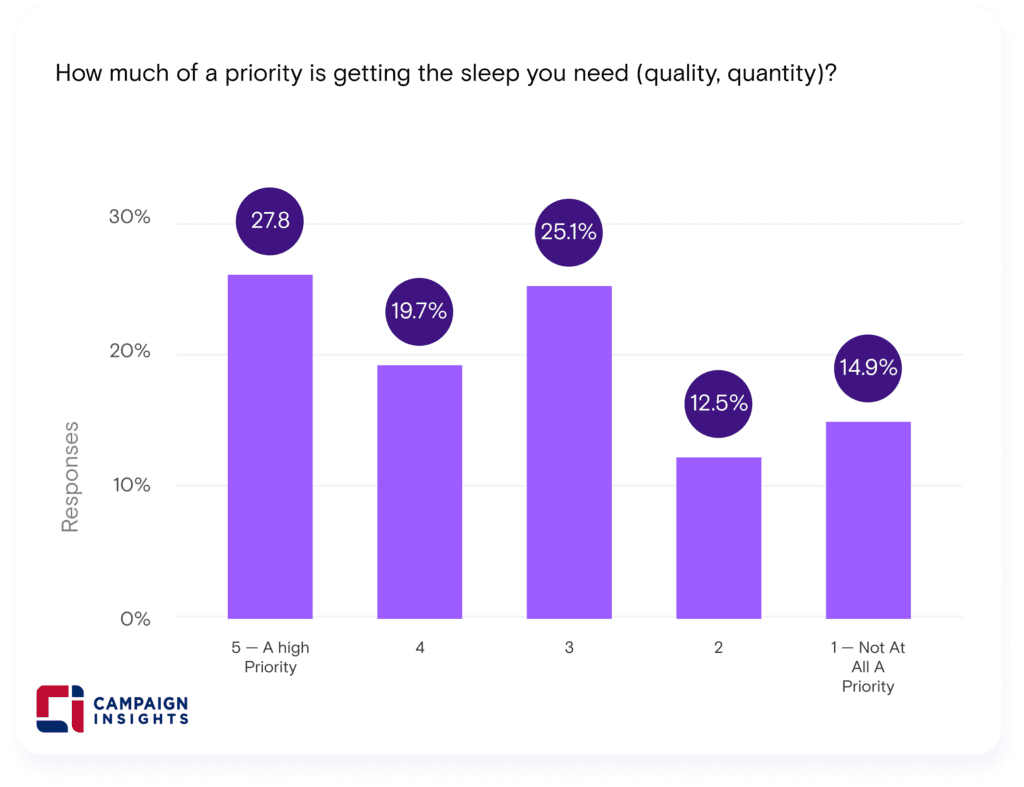

- Commitment to change. The problematic nature of sleep and its potential to significantly subtract from our quality of life means that many people have resolved to do better. Nearly half of all respondents (47%) place a high priority on getting their required sleep. Our results also revealed a highly motivated minority that is willing to devote money, time, and effort toward feasible ways to improve sleep — both in terms of quality and quantity. The demographic profile of this segment may come as a surprise, as it skews toward men and the Gen Z cohort.

Results

Digging Deeper

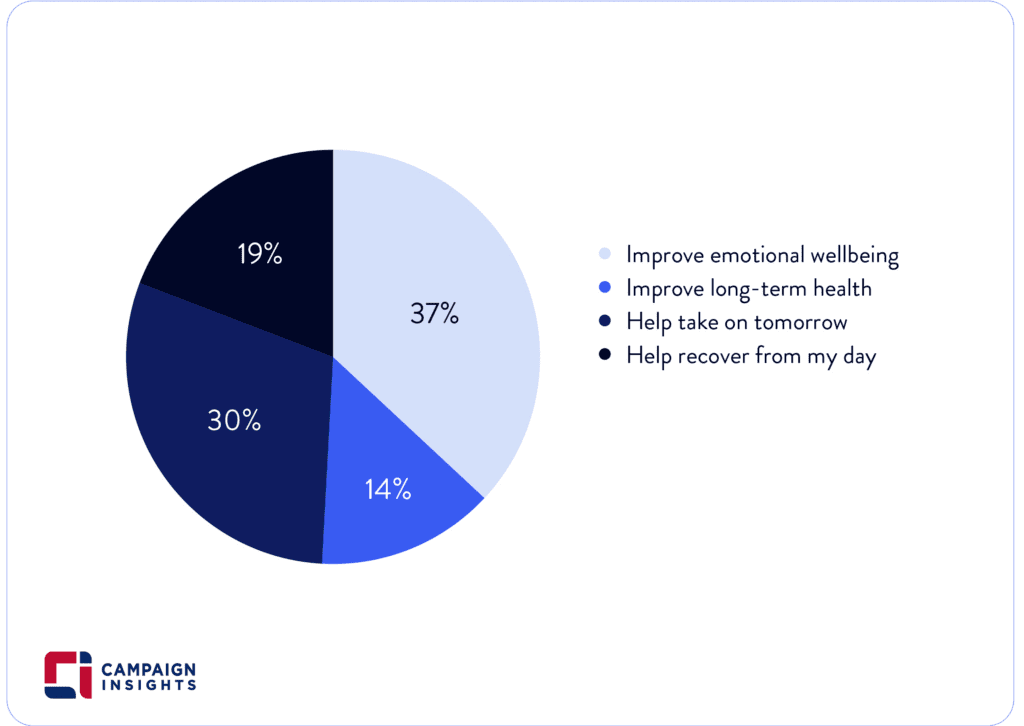

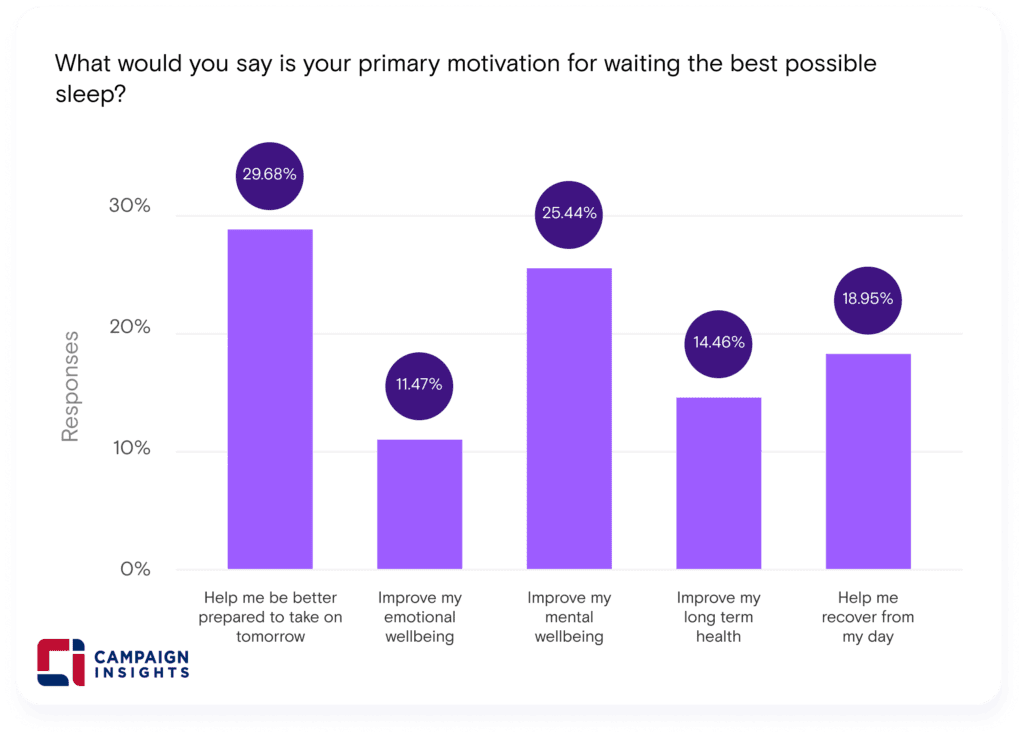

The pie chart below offers an interpretation of the different ways in which people frame the benefits of sleep. Some respondents focus on future health benefits, such as improvements in short-term mood and outlook (37%). Others believe good sleep can yield a long-term improvement in overall health (14%). Additional respondents frame the sleep opportunity in a more temporal fashion, casting their gaze forward — like the 30% seeking help “to take on tomorrow” — while a somewhat smaller proportion are, well, just tired and want “to recover from my day” (19%).

The Motivational Nexus

Given the reported desire for good health and restorative

preparedness, nearly half of our sample placed a high priority on meeting their sleep needs (47% chose the top two levels on our five-point priority scale). By way of comparison, only one in four respondents assigned it as low priority (with 15% saying it was not at all a priority).

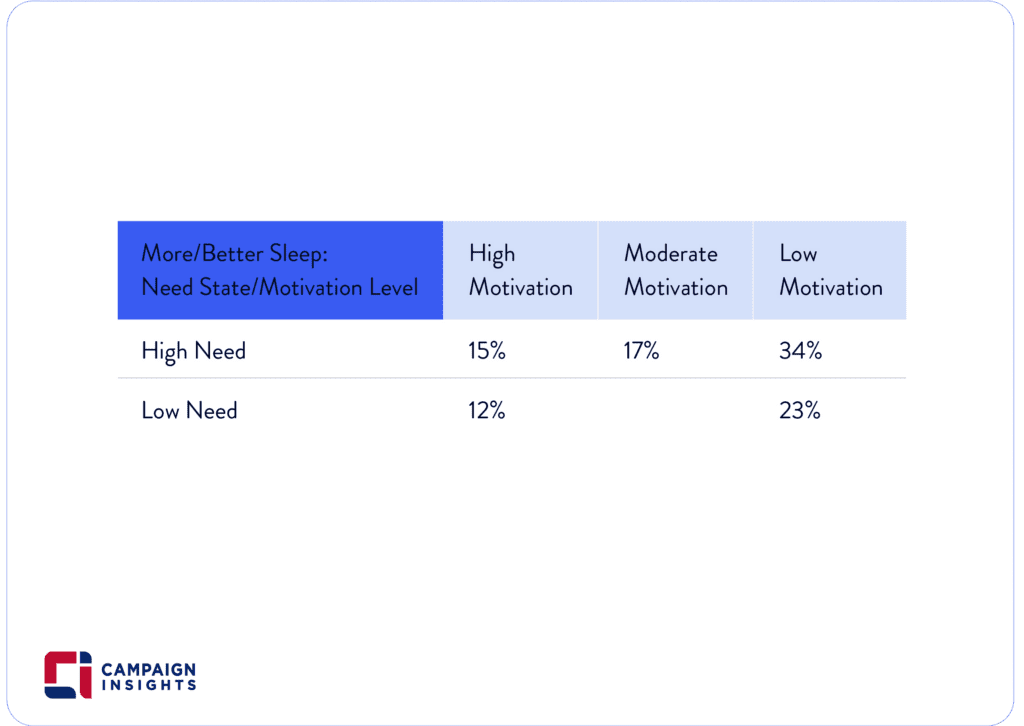

We sought to tease out this motivational nexus further by measuring the relative strength of the respondents’ motivation to work toward (or in some cases, continue to get) better sleep, their willingness to allocate resources to its achievement and, finally, the frequency of taking the steps to improve or maintain their necessary sleep.

In short, among the two-thirds of respondents who reported a

need for more sleep, one out of four further indicates a high

motivation to improve their sleep. And to this number of highly motivated folks, we should also add the roughly one-third of the low-need segment who — though currently getting what

they perceive as their required sleep — are highly motivated to keep their sleep patterns and outcomes intact. Overall, 27% of our total sample are highly motivated to achieve more or better sleep. An additional 25% report moderate levels of motivation.

Selling Sleep

The worldwide market for sleeping aids is slated to surpass $100 billion by 2026. Our survey data suggests dissatisfaction with sleep quality and quantity, further amplified by large sub-segments in this market who report a strong motivation to find and adopt the means to better sleep.

At the same time, our survey results suggest a considerable diversity of opinions and expectations about the role of sleep and the range of benefits it potentially bestows. Approaches to

better sleep seem just as numerous, with solutions stemming from healthcare providers, pharmaceutical companies, alternative medicine practitioners, and proponents of certain lifestyle adjustments and home remedies.

Further applied research may wish to map the data variation in

our survey with deeper insight into how individuals define both sleep problems and solutions. Surveys and other research tools can refine this segmentation approach and inform our understanding of the various means and methods appropriate by

those affected by insomnia and other people similarly disposed

to improve their sleep. The pathway from sleepless nights to better

sleep is not likely to be a straight line, but rather a more circuitous

route with bumps and bottlenecks. Combining survey, search, and ethnographic explorations will likely yield helpful consumer journey maps of the long and winding road to dreamland.

Sub-Group Analysis

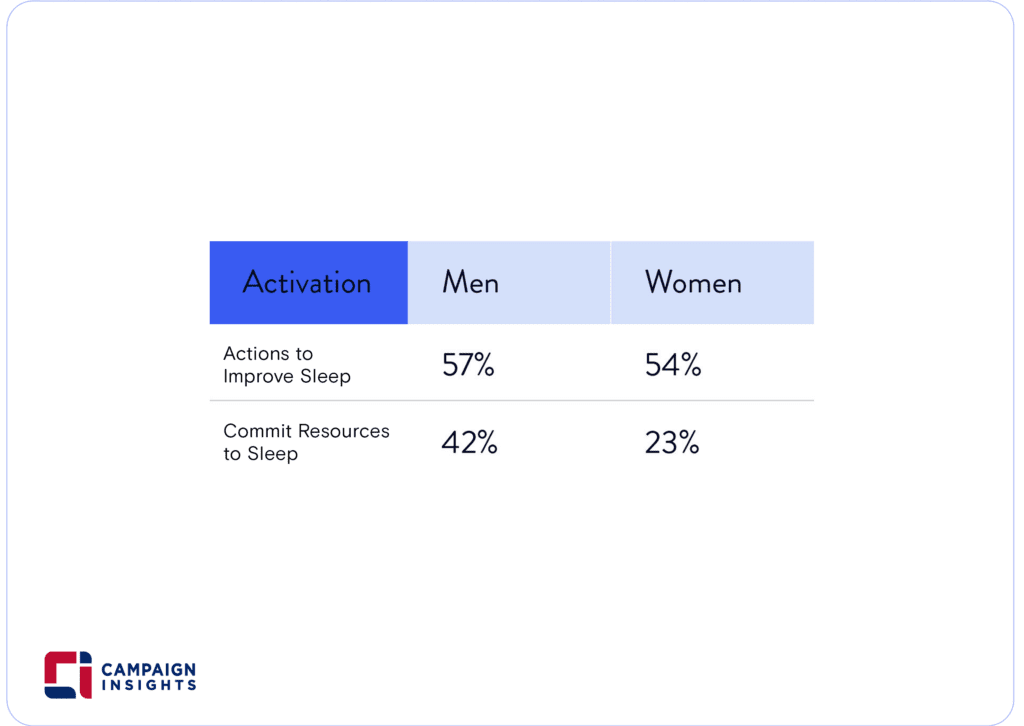

Our analysis of the sub-group sentiments did not detect wide variations across demographic categories such as age. We expected higher age might correlate with more sleeping issues and concerns, but we did not find compelling evidence to back this prediction. We did, however, find relatively strong gender-related patterns. In general, men were more likely to report heightened motivation to improve sleep compared to the women in our survey. The disproportionate representation of men to women in our high-need/high-motivation segment reflected that men expressed a

greater likelihood of taking action to improve sleep and devote resources to that goal.

The Process

From April 15 to 28, 2021, Realtime Polling questioned 1,254 Americans about their sleeping status and satisfaction. This is a follow-up

project to our sleep survey conducted during National Sleep Awareness Month (March 2021).

Campaign Insights used their Realtime Polling tool to learn how people understand the role of sleep, they reported adequacy of sleep, and their relative need and motivation to manage or otherwise improve their sleep.

Questions We Asked

- In a typical week, how many nights would you say you get the sleep you need?

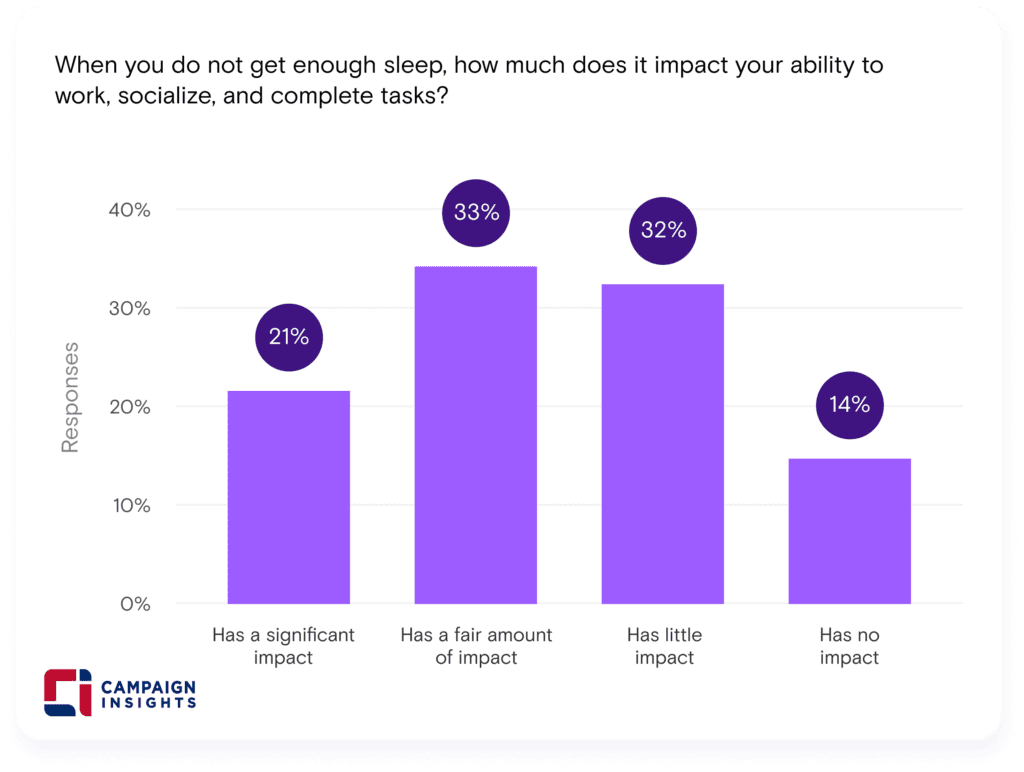

- When you do not get enough sleep, how much does it impact your ability to work, socialize, and complete tasks?

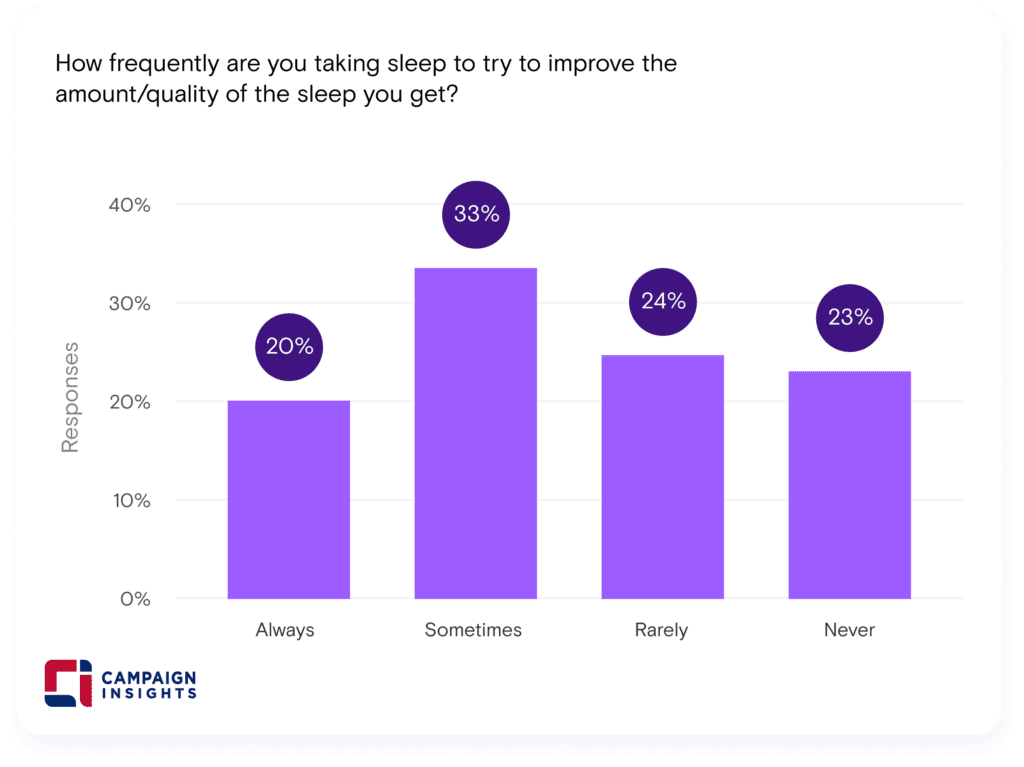

- How frequently are you taking steps to try to improve the amount/quality of the sleep you get?

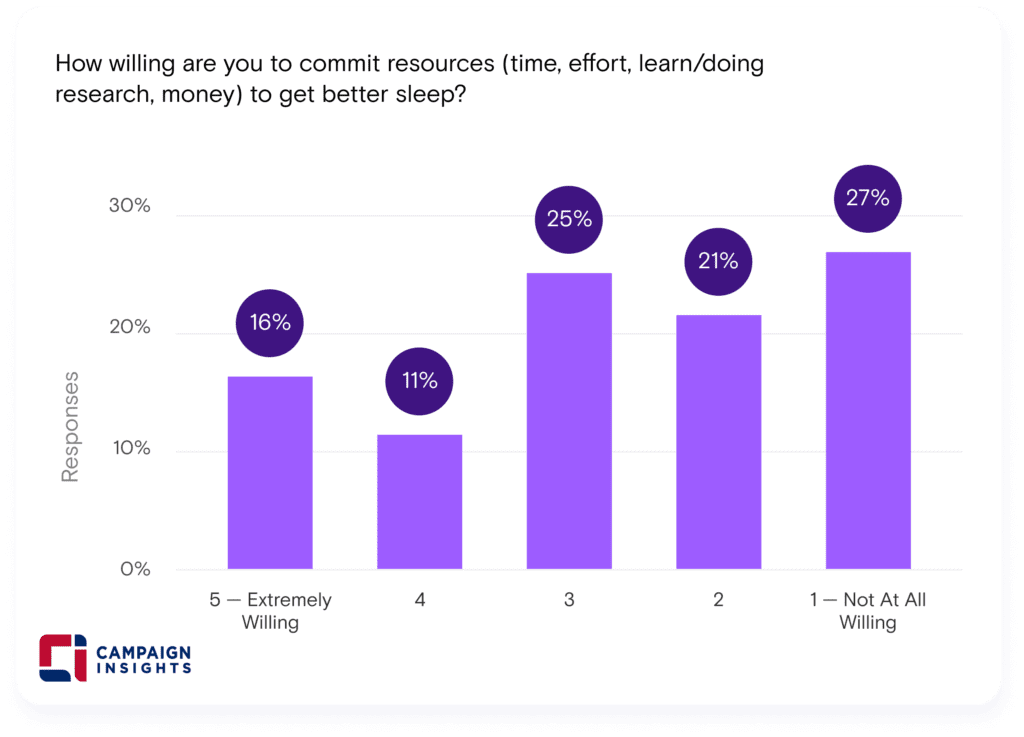

- How willing are you to commit resources to getting better sleep?

- Which of the following best represents the role of sleep in your life?

- What would you say is your primary motivation for wanting the best possible sleep?

- Which of the following is your biggest struggle when it comes to getting the sleep you need?

- How much of a priority is getting the sleep you need?

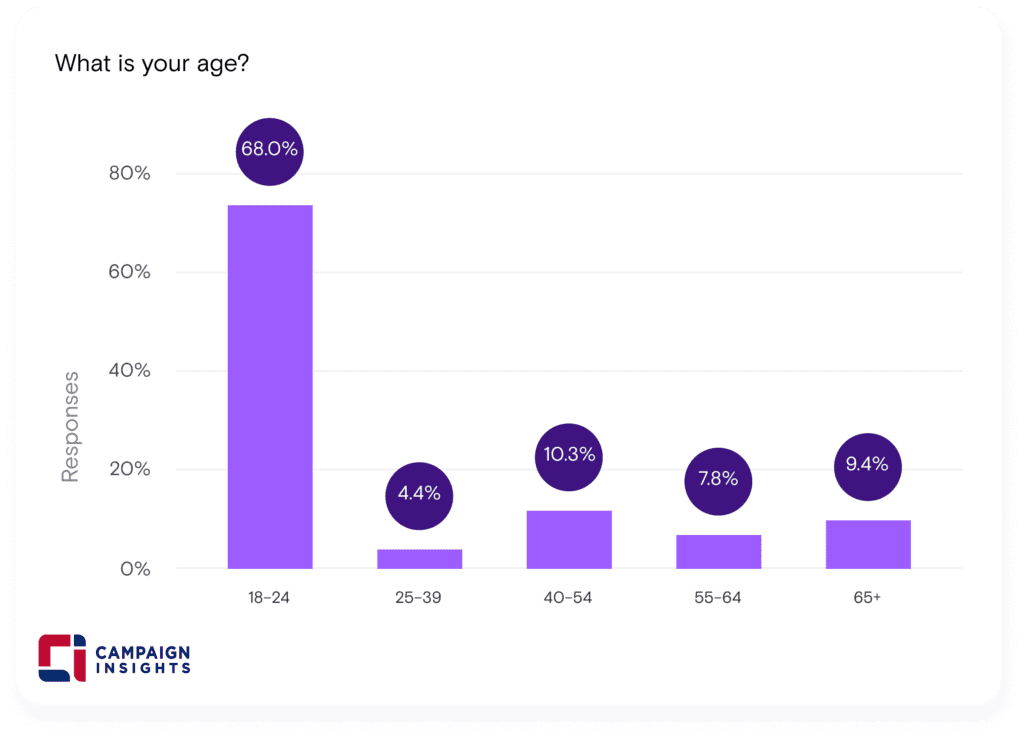

- What is your age?

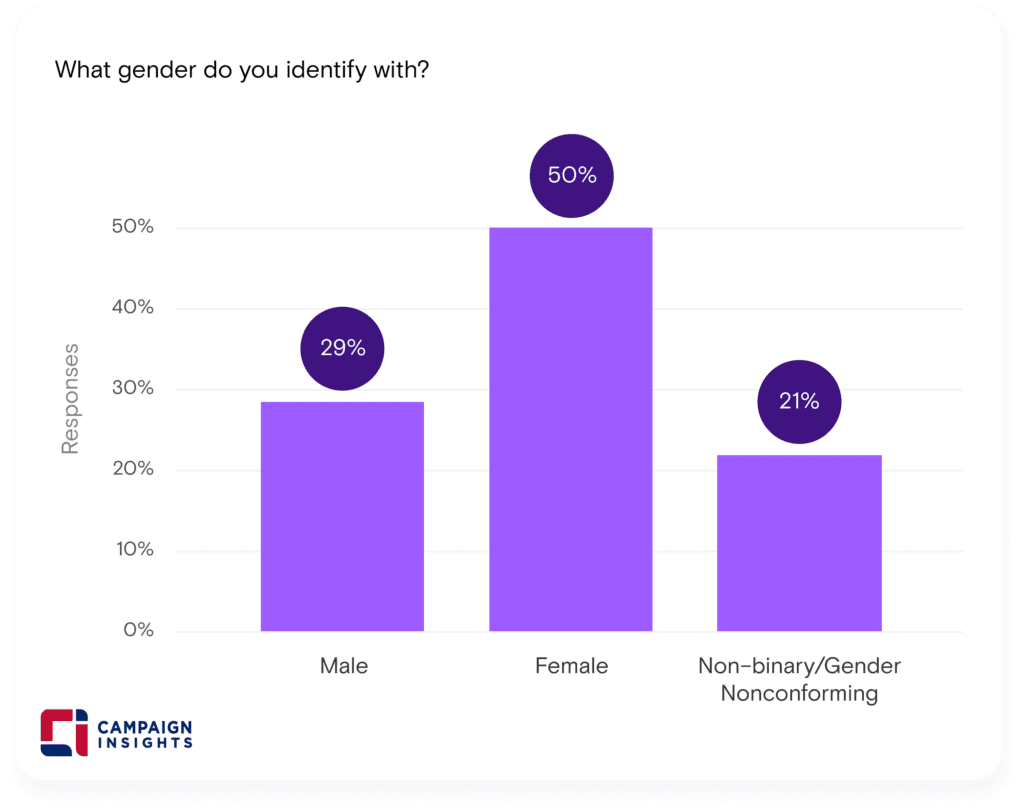

- What gender do you identify with?

Discussion

We learned that Americans, while having a wide range of opinions about the role of sleep in their lives and its contribution to their wellbeing, are generally dissatisfied with their sleep. Nearly 50% are making a significant effort to get the sleep they need. Furthermore, a very substantial number — more than one in four of our respondents — are highly motivated to achieve better sleep. They are willing to devote time, money, and effort in pursuit of this important health and lifestyle goal. This motivation and engagement skewed somewhat more toward male respondents. And those from Gen Z seem just as preoccupied with the search for good sleep as their elders, especially keen to capture an improved mental outlook.

A.J. Ghergich, Chief Digital Officer at Brado, an insight-driven

marketing agency, says the healthcare industry is undergoing a great wave of consumerization. “This,” he says, “means that the patient or consumer is using a wide range of tools and techniques to improve their health and overall wellbeing.”

“Sleep is an area especially ripe for innovation,” Ghergich says, “as people generally recognize its importance for maintaining health and peak performance.” The challenge, as this survey suggests, is to channel both the dissatisfaction that so many consumers have with their current sleep habits and their reported motivation to do better.

“We don’t have any magic elixir to improve sleep, but we do have a wealth of diagnostic approaches that are aligning with feasible strategies to boost our sleep health,” Ghergich says. “We expect to see more and more of these in the digital health space and look forward to asking consumers about their perceived effectiveness in future surveys.”

Our partners at Brado use search analysis to refine questionnaire design, as their Database of Intentions methodology mines search queries to stake out detailed journey maps and useful inventories of Jobs to be Done (JTBD), a research methodology intended to isolate or otherwise clarify the various aims and solutions (i.e., jobs) consumers are seeking out. For example, applying a search filter to this survey-based approach supports an iterative process whereby first-stage discoveries (e.g., people infrequently get the sleep they need) can be expanded by mining

frequent causes of poor sleep. This data can, in turn, point to possible sleep disorder diagnoses as well as potential remedies to help people get the sleep they want and need.

Campaign Insights Realtime Polling surveys differ from traditional online surveys in that the questions are shown to the user on web pages in place of an ad. Unlike Google Surveys, which block access to content until the questions are answered, Realtime Polling surveys are optional, thus ensuring that participants are responding voluntarily.